Automotive

Businesses

for

Sale

Selling

an

Automotive

Business

Be

Your

Own

Boss

Want to Know

What Your

Business Is

Worth?

Are You

Considering

a Franchise

Opportunity?

Art Blumenthal

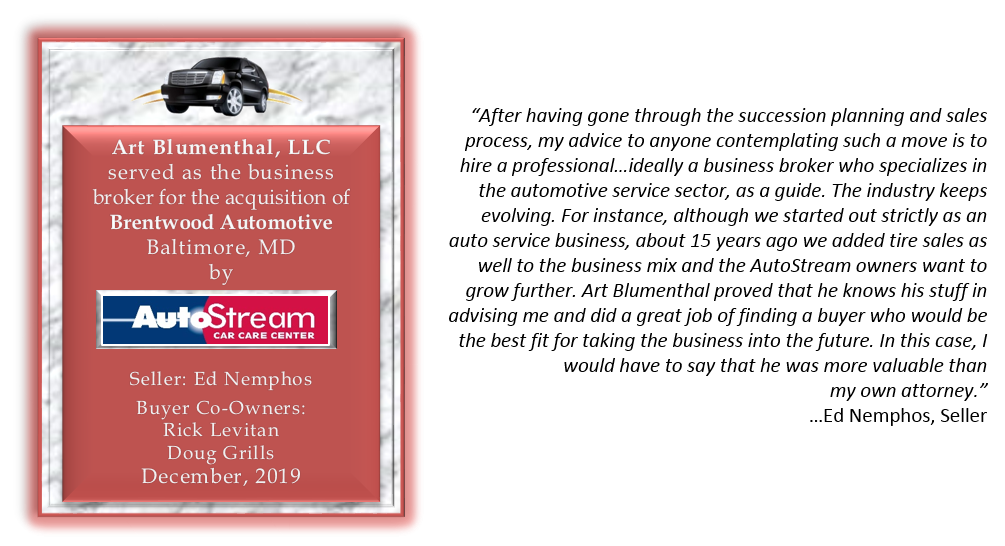

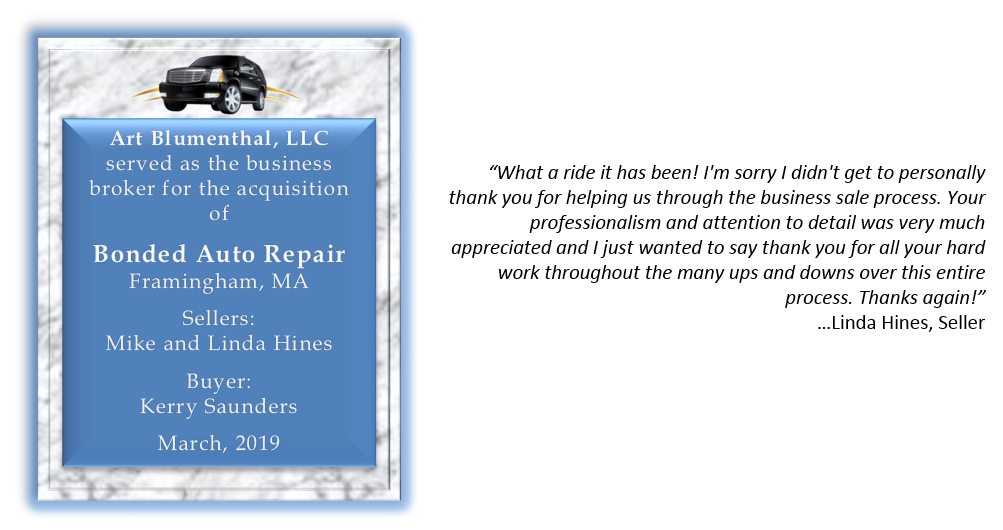

Now, by leveraging the experience, in-depth knowledge, and extensive contact network I’ve achieved in over 40 years in the tire and automotive aftermarket industry, I’ve been able to establish and grow one of the leading nationwide aftermarket-specific business brokerage service firms, bringing value-added benefits to both buyers and sellers.

“Consider this before selling your tire shop”

(Published by Tire Business)

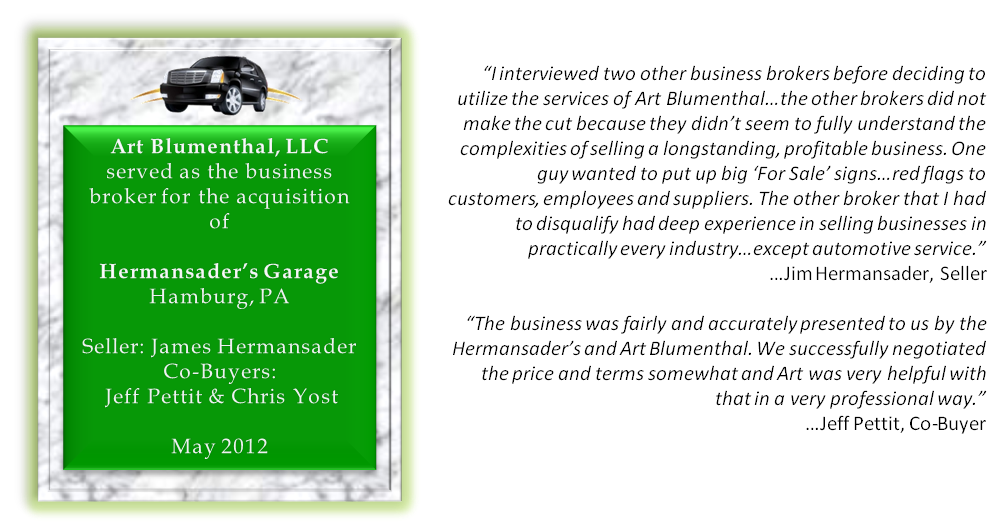

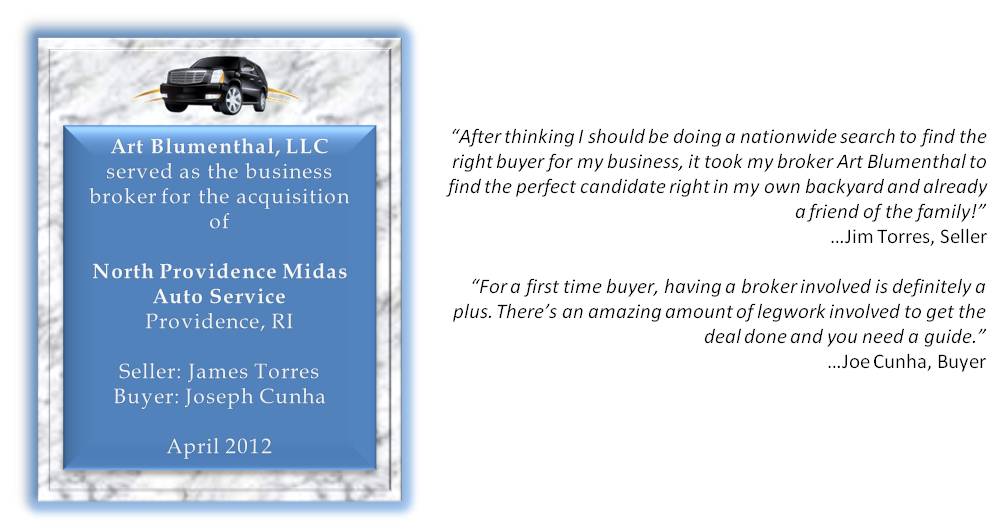

Testimonials

Our Services

Selling A Business

Your business isn't just any business. It is a living monument to late-night homework and early-morning deadlines. It is an accumulation of sweat, equity, and lifetime achievement.

Therefore, the decision to sell your business is one of the most important decisions of your lifetime. Turning your operation into cash is a complex matter involving a number of variables, many of them unique to your business. Additionally, you're likely to face an uncertain economy, unbridled competition, and sophisticated buyers.

I provide competent and experienced professional guidance, so you will not be facing them alone.

Exit Planning

If you've begun giving serious thought to exiting your business within the next 1 to 5 years, now is the time to start the process. Exiting is a multi-step process that can take from weeks to years depending on the size of the organization and how well prepared the business is to present to buyers and receive the highest sale price possible.

When it comes to planning, how you exit your business is just as important as how you start it. The goal is to maximize the value of your company before converting it to cash and minimize the amount of time consumed.

Getting out of business is a process. The length of time required to complete the process is directly related to the complexity of the business and the scope of action steps that you can immediately implement to improve the financials and make your business more desirable to the pool of available buyers.

Business Valuation

An inaccurate view of the value of your business will adversely impact the success of the sales effort.

A properly determined and executed business valuation is essential when the owner is ready to consider selling the business. You don’t want to leave money on the table with a selling price that undervalues the business, while overvaluing the business may result in little buyer activity and a listing that languishes on the market.

Most business owners use tax returns or financial statements prepared for tax purposes as the basis for the financial presentation of their business. As a result, the true market value of the assets is not reflected because of an understated cash flow that does not include depreciation, interest payments, personal expenses or other owner benefits that are written off for tax purposes.

While this may be good for saving you taxes, it can result in a sale price that does not reflect your years of hard work to build a successful and profitable business. A business intermediary will prepare a “Recasted Schedule of Seller’s Discretionary Cash Flow” that adds back the financial benefits that a buyer will receive that are not presented on the tax return.

As the business intermediary, I have reviewed literally hundreds of tax returns and financial statements, which allow me to instantly spot expense levels that are outside of the aftermarket norms. I have the knowledge, dedication and experience to provide a broker’s opinion on the “Most Likely Selling Price” that is based upon well over one hundred facilitated transactions and years of following sales of aftermarket businesses on a nationwide basis.

Buying A Business

Unless you've bought or sold a business in the past, you'll find that buying a business can be a confusing and even trying experience.

That's why it is important for the prospective buyer to be knowledgeable about the process involved in buying a business.

Thoroughly understanding the process will assist even a veteran of business transfers in working with me as the intermediary.

From Our Blog

The Emotional Side of Selling Your Business

It is easy to get lost in the numbers when it comes to selling your business, but it is important to remember that the numbers only tell one side of the story. Both buying and selling a business come with significant mental and emotional ramifications. Why is this so critical to understand? Sellers who are…

Read MoreWhy Should You Buy an Established Business?

A pre-existing business is a proven commodity. A new business, regardless of how great your idea may be, will always have a future that is uncertain. You can hire many consultants and plan meticulously. Yet, even with the best ideas and most experienced consultants, your newly minted business could still quickly fail. A business with…

Read MoreWhat Should You Expect from Your Business Intermediary?

Eventually every business owner needs to sell or think about who will take over their business when they retire. Working with an intermediary is an easy and streamlined way to jumpstart the process and learn what mistakes to avoid. A business broker or M&A advisor can help you to understand what steps to take to…

Read More